unlevered free cash flow enterprise value

Unlevered Free Cash Flow also known as UFCF or Free Cash Flow to Firm FCFF is a measure of a companys cash flow that includes only items that are. Unlevered free cash flow is generated by the enterprise so its present value like an EBITDA multiple will give you the Enterprise value.

Discounted Cash Flow Analysis Street Of Walls

As you can see in the example above row 172 produces Unlevered Free Cash Flow the same thing as FCFF.

. Heres a formula for UFCF. When performing a discounted cash flow with unlevered free cash flow - you will calculate the enterprise value. It is defined as Enterprise Value divided by Free Cash Flow.

Enterprise Value to Free Cash Flow compares the total valuation of the company with its ability to generate cashflow. Unlevered free cash flow is the gross free cash flow generated by a company. Discounted Cash Flow Analysis.

Weighted-Average Cost of Capital. When you value a business using unlevered free cash flow in a DCF model you are calculating the firms enterprise value. 1 0 Y A F C F O S O W P S P L C A I where.

Unlevered cash flows are cash flows to both debt and equity holders. That is the reason you discount them back wacc because wacc reflects the riskiness of both cash flows to debt and equity holders. The average consumer may not ever see or need to know this amount.

Adjusted Present Value Analysis. Stockopedia explains EV FCF. Related to or available to all investors in the company Debt Equity Preferred and others in other words Free Cash Flow to ALL Investors AND.

Levered and Unlevered Calculating free cash flow from the cash flow statement also depends on the type of FCF. Value Creation in an LBO. Free Cash Flow to Equity.

If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value. Free cash flow is calculated as EBIT or operating income 1 - tax rate Depreciation Amortization - change in net working capital - capital expenditures. Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to.

They are similar to the levered cash flows or free cash flow to equity except they value its operations. The enterprise value EV of the business is calculated by discounting the unlevered free cash flows UFCFs projected over the projection period and the terminal value calculated at the end of the projection period to their present values using the chosen discount rate WACC. UFCF is helpful when a corporation wants to.

Enterprise Value is used with Unlevered Free Cash Flows because this type of cash flow belongs to both debt and equity investors. The unlevered free cash flows used to value any company represent the companys enterprise value and those cash flows are available to all shareholders including equity and debt holders. Unlevered Free Cash Flow.

This metric may also be called free cash flow to firm FCFF. Another reason for its prominence is that most multiple-based valuation techniques like comparable analysis use enterprise value EV. The Enterprise Value to Free Cash Flow Ratio or EV FCF Ratio contrasts a companys Enterprise Value relative to its Free Cash Flow.

This is measured on a TTM basis. The enterprise value which can also be called firm value or asset value is the total value of the assets of the business excluding cash. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity holders.

However Equity Value is used with Levered Free Cash Flow as Levered Free Cash Flow includes the impact of interest expense and mandatory debt repayments and therefore belongs to only equity investors. When using unlevered free cash flow to determine the Enterprise Value EV Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest of the business a few simple steps can be taken to arrive at the equity value of the firm. Unlevered free cash flow is usually only visible to financial managers and investors rather than to the average consumer.

Formula from EBITDA EBITDA FCFF. Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. Leverage is another name for debt and if cash flows are levered that means they are net of interest payments.

What is Levered Free Cash Flow. Capital Structure of an LBO. Showcase enterprise value to investors Offer a comparison of enterprise value to other businesses Determine net present value NPV.

Unlevered FCF EBITDA CapEx Working Capital Tax Expense Or Unlevered FCF Net Income DA Capex Working Capital Lets see the use of the formula in the DCF model in the example below. Unlevered free cash flow is the free cash flow available to pay all stakeholders in a firm including debt holders and equity holders. It showcases enterprise value to debtholders with a stake in the companys financial wellbeing.

Free Cash Flow from Cash Flow Statement. Now when you discount unlevered cash flows you will get your EV which is the total value of the firms debt and equity more precisely Equity Net debtprefered. How to calculate the Unlevered Free Cash Flow.

The enterprise value which can also be called firm value or asset value is the total value of the assets of the business excluding cash. If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value TEV. This metric is most useful when used as part of the discounted cash flow DCF valuation method where its benefits shine the most.

Which is based on the cash flow derived from 100 ownership of all assets and therefore determines a companys Enterprise Value. From there the XNPV function is used to calculate Net Present Value which is the EV in cell C197. Using Unlevered Free Cash Flow the formula is Net Income Interest Interest tax rate DA NWC CAPEX.

1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O. Enterprise and Equity Values. Unlevered free cash flow UFCF is used at a high level to determine the enterprise value of a business.

Using simple Free Cash Flow the formula is Net Income DA NWC CAPEX.

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formulas Definition Example

Discounted Cash Flow Analysis Street Of Walls

Fcf Yield Unlevered Vs Levered Formula And Calculator

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

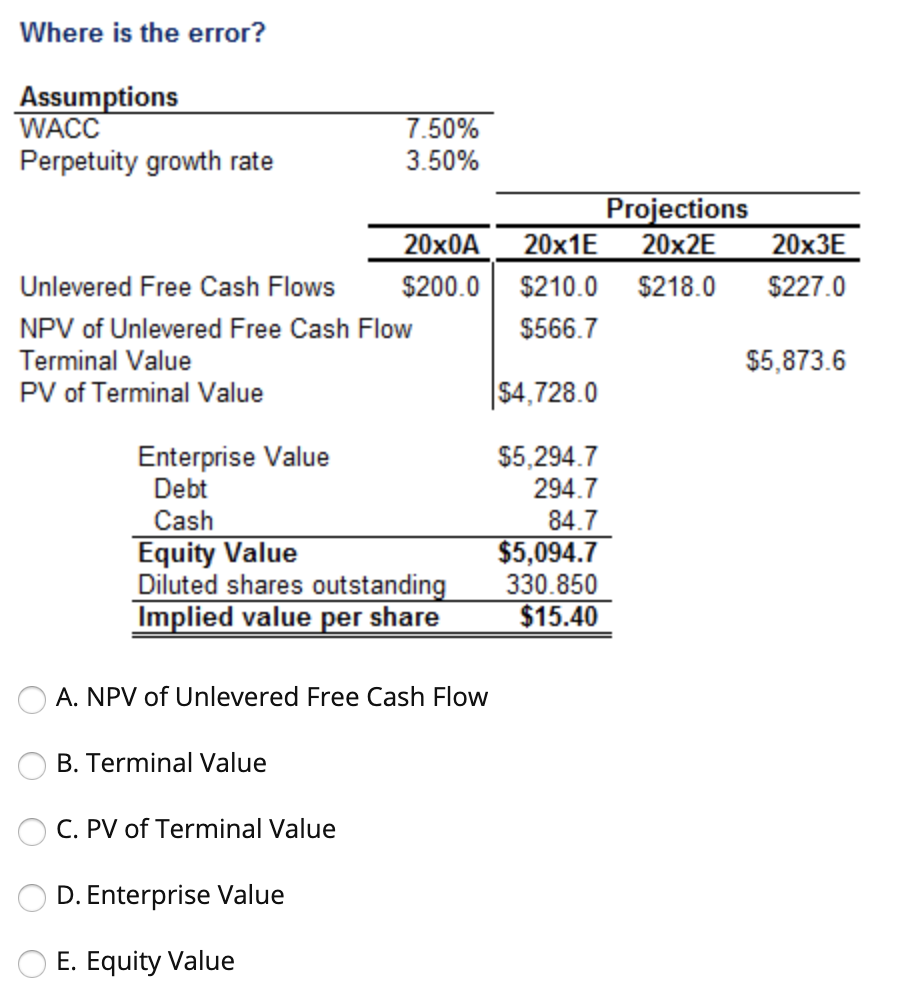

Solved Where Is The Error Assumptions Wacc Perpetuity Chegg Com

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

Fcf Yield Unlevered Vs Levered Formula And Calculator

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial